4 Simple Techniques For Financial Advisor License

Wiki Article

Some Known Details About Financial Advisor Definition

Table of ContentsHow Financial Advisor Magazine can Save You Time, Stress, and Money.Financial Advisor Certifications - QuestionsThe Of Financial Advisor DefinitionThings about Financial Advisor Magazine

There are numerous sorts of monetary consultants out there, each with differing qualifications, specializeds, and degrees of accountability. As well as when you're on the hunt for a professional suited to your requirements, it's not uncommon to ask, "Just how do I know which economic advisor is best for me?" The response begins with a truthful accounting of your requirements and a little of research.That's why it's necessary to research study prospective experts and understand their certifications before you hand over your money. Sorts Of Financial Advisors to Consider Depending on your monetary demands, you might go with a generalized or specialized monetary expert. Understanding your options is the initial step. As you start to study the globe of seeking out an economic consultant that fits your needs, you will likely be presented with lots of titles leaving you wondering if you are calling the right individual.

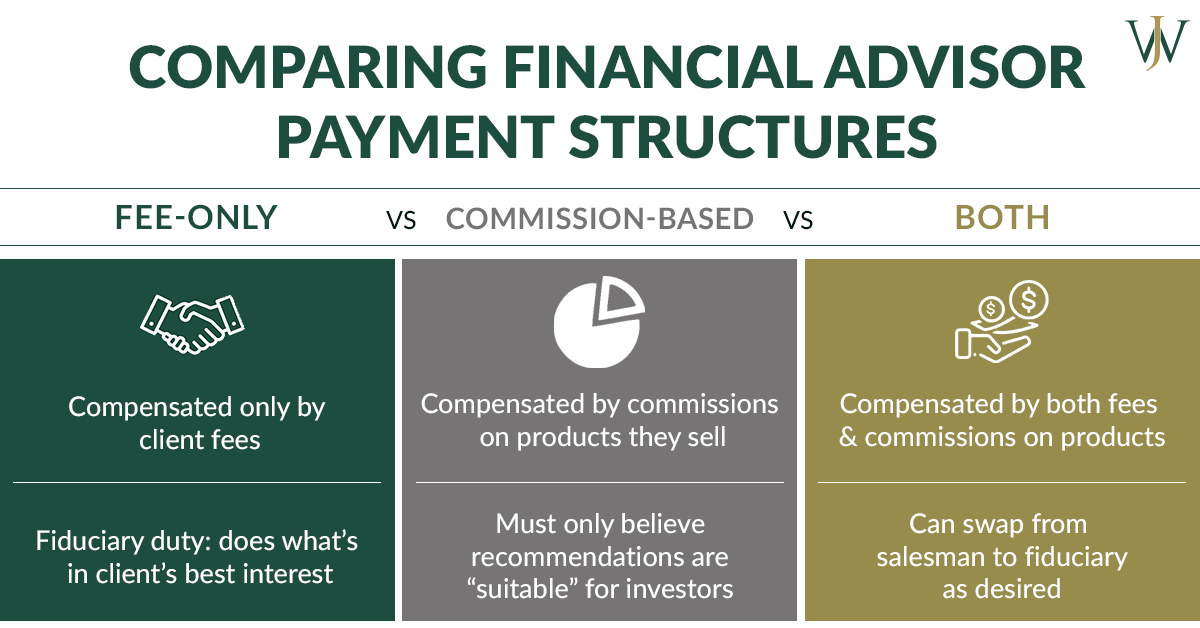

It is important to note that some monetary advisors additionally have broker licenses (definition they can market protections), yet they are not solely brokers. On the exact same note, brokers are not all certified just as as well as are not financial consultants. This is just among the numerous reasons it is best to start with a certified economic planner who can recommend you on your financial investments and also retirement.

Financial Advisor Meaning for Beginners

Unlike financial investment advisors, brokers are not paid directly by clients, rather, they make payments for trading stocks and also bonds, as well as for offering common funds and also other products.

A certified estate organizer (AEP) is a consultant that specializes in estate planning. When you're looking for a monetary advisor, click for more it's nice to have a concept what you want assistance with.

Much like "economic advisor," "monetary organizer" is also a broad term. Regardless of your certain demands as well as monetary scenario, one requirements you ought to highly consider is whether a potential expert is a fiduciary.

Not known Factual Statements About Financial Advisor Job Description

To protect on your own from a person that is merely attempting to get more cash from you, it's a good idea to look for a consultant who is signed up as a fiduciary. An economic expert who is signed up as a fiduciary is required, by regulation, to act in the finest passions of a customer.Fiduciaries can just encourage you to use such products if they think it's actually the best monetary decision for you to do so. The United State Securities and also Exchange Payment (SEC) controls fiduciaries. Fiduciaries that fall short to act in a client's finest interests could be hit with fines and/or jail time of as much as 10 years.

Nonetheless, that isn't because anyone can obtain them. Receiving either qualification needs someone to go via a variety of courses and examinations, along with gaining a set amount of hands-on experience. The outcome of the accreditation process is that CFPs as well as Ch, FCs are skilled in topics throughout the field of personal money.

The cost might be 1. Charges normally reduce as AUM increases. The option is a fee-based consultant.

About Financial Advisor Fees

A consultant's administration charge may or may not cover the costs connected with trading safeties. Some advisors likewise charge an established cost per purchase.

This is a service where the consultant will certainly pack all account management expenses, consisting of trading costs as well as expense proportions, right into one thorough cost. Because this charge covers financial advisor bdo extra, it is typically greater than a cost that just consists of monitoring financial advisor course as well as leaves out points like trading costs. Cover fees are appealing for their simplicity yet likewise aren't worth the expense for everybody.

They additionally bill costs that are well listed below the advisor fees from standard, human consultants. While a typical advisor usually charges a fee between 1% and 2% of AUM, the fee for a robo-advisor is typically 0. 5% or much less. The big trade-off with a robo-advisor is that you commonly do not have the capacity to chat with a human consultant.

Report this wiki page